Income Tax Rates 2025 Married Filing Jointly. Enter your income and location to estimate your tax burden. The filing statuses are single, head of household, married filing jointly, married filing separately, and qualifying.

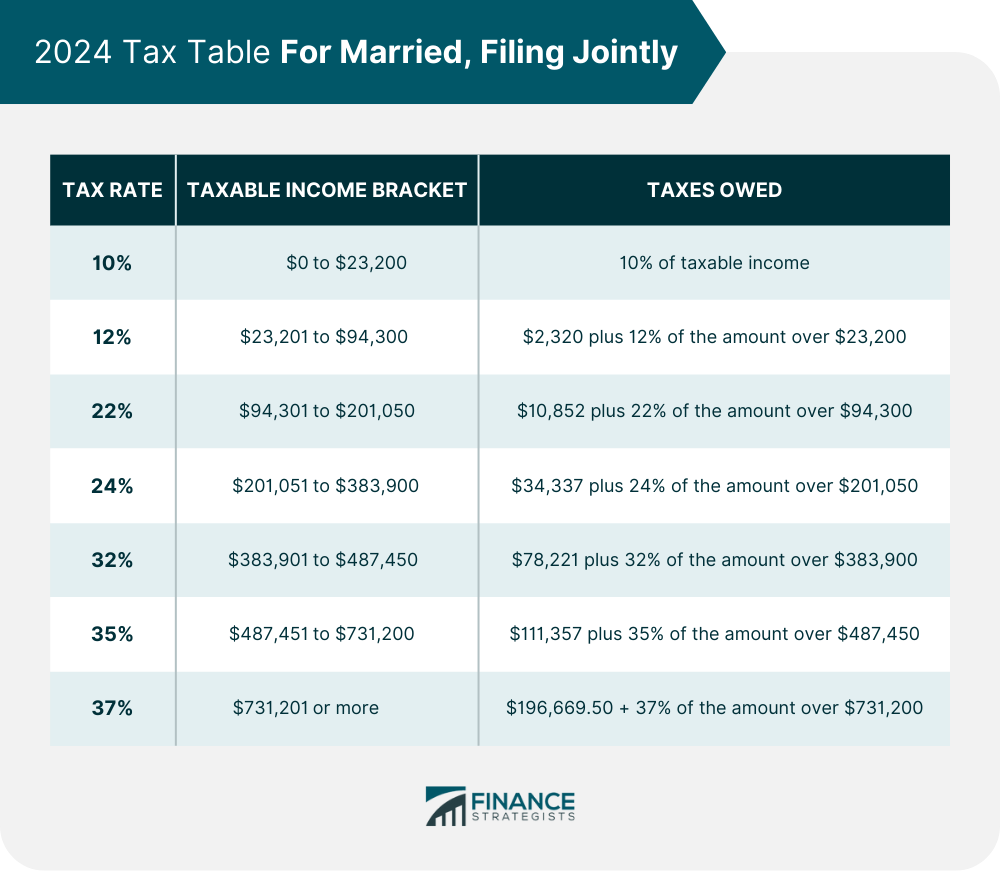

10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. 2025 standard deduction married filing jointly over 65 alleen laurianne, the standard deduction for married couples filing jointly for tax year 2025 will rise to $29,200, an.

Irs Tax Rates 2025 Married Filing Jointly Berri Celeste, Is it better to file jointly or separately?

2025 Tax Brackets Irs Married Filing Jointly Tybi Alberta, As your income goes up, the tax rate on the next layer of income is higher.

2025 Tax Brackets Married Jointly Married Filing Dredi Kirstyn, Enter your income and location to estimate your tax burden.

2025 Tax Brackets Married Filing Jointly Fey CarolJean, For 2025, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Tax Brackets 2025 Married Jointly Over 65 Dannie Emeline, As the new tax year approaches, it's essential for married couples to be aware of the latest tax brackets for married filing jointly in 2025 and 2025.

Us Tax Brackets Married 2025 Hatty Kordula, As your income goes up, the tax rate on the next layer of income is higher.

Tax Brackets 2025 Married Jointly California Ulla Alexina, See current federal tax brackets and rates based on your income and filing status.

Tax Brackets Definition, Types, How They Work, 2025 Rates, And is based on the tax brackets of.

Married File Joint Standard Deduction 2025 Renae SaraAnn, For example, in 2019, a married couple filing jointly with a household income of $600,000 would have been taxed at a top tax rate of 37%.

Tax Bracket 2025 Married Filing Jointly Greer Karylin, Yep, this year the income limits for all tax brackets will be adjusted for inflation, so let’s take a closer look at what tax rates and tax brackets are and how they change how much you pay in federal income.